Cell Therapy Market

Cell Therapy Market Outlook 2034: Growth, Trends, Opportunities, and Forecast Analysis

Published Date: August - 2025 | Publisher: MRA | No of Pages: 110 | Industry: Healthcare | Format: ![]()

Cell Therapy Market Size Trends & Growth

·

The global cell therapy market was valued at US$ 5.1 Bn in 2024.

·

The industry is expected to expand at a CAGR of 22.9% from 2025 to

2034.

·

By the end of 2034, the market size is projected to exceed US$ 51.6

Bn.

·

Strong R&D investments, rising prevalence of chronic diseases, and

advancements in regenerative medicine are driving this growth.

Market Definition & Scope

Cell therapy

is a branch of regenerative medicine involving the administration of living

cells to repair, replace, or regenerate damaged tissues and organs. Therapeutic

cell sources include adult stem cells, induced pluripotent stem cells (iPSCs),

embryonic stem cells, immune effector cells (e.g., T cells, NK cells), and

dendritic cells. Approaches may be autologous (patient-derived) or allogeneic

(donor-derived), and can incorporate genetic engineering (e.g., CAR-T,

engineered TCR-T) to enhance targeting and persistence.

Key Market Trends & Insights

- Growing adoption of

personalized medicine and precision oncology.

- Rapid expansion of clinical

trials in regenerative and cell-based immunotherapies.

- Strong R&D investments from

biopharma and governments; improving funding climate for manufacturing

scale-up and platforms.

- Advancements in gene editing,

vector design, and manufacturing (closed, automated systems, QC analytics)

that reduce cost and improve reproducibility.

- Supportive regulatory pathways

and expedited designations that compress timelines to approval.

- Rising clinician and patient

awareness of cell therapy benefits, supported by maturing real‑world

evidence.

Future Outlook & Opportunities

- Broader use of engineered cell

therapies beyond hematologic malignancies to solid tumors (overcoming TME

barriers, next‑gen CARs, armored cells).

- Expansion into autoimmune,

neurological, and cardiovascular indications via immune resetting, tissue

regeneration, and anti-inflammatory mechanisms.

- Growth in off‑the‑shelf allogeneic

platforms (e.g., iPSC‑derived) to improve access, logistics, and margins

versus bespoke autologous models.

- Industrialization

opportunitiesvector supply, closed-system manufacturing, analytics, cell

handling logistics, cryo-chain and digital tracking.

- Emerging markets and APAC

manufacturing hubs; partnerships with hospitals/academic centers for

point-of-care models.

- Health-economic evidence and

innovative reimbursement (outcomes-based, annuity models) to drive payer

adoption.

Cell Therapy Market Size, Trends & Growth Drivers

The global cell therapy market is experiencing rapid expansion, driven by strong R&D investments, rising prevalence of chronic diseases, and continuous advancements in regenerative medicine. Increasing demand for innovative therapies to treat cancer, cardiovascular disorders, and autoimmune diseases is further fueling market growth. Companies are heavily investing in clinical trials and product innovation to improve treatment efficacy and accessibility. Among regions, North America dominated the global cell therapy market in 2024, holding the largest market share. This dominance is attributed to advanced healthcare infrastructure, high adoption of novel therapies, significant research funding, and favorable regulatory support in the region.

Detailed Market Narrative

Cell Therapy Market Outlook

Cell therapy

leverages the unique properties of cells to repair or regenerate tissues across

multiple therapeutic domains. Development typically begins with selecting

appropriate cell sources—adult stem cells, iPSCs, embryonic stem cells, or

immune cells—followed by isolation and, when applicable, genetic modification

to enhance therapeutic function.

Illustrative

exampleCAR‑T

(Chimeric Antigen Receptor T‑cell) therapy is created by extracting a patient’s

T cells, engineering them to express receptors that target tumor antigens,

expanding the modified cells, and reinfusing them to eliminate cancer cells.

Applications

span orthopedics, cardiology, immunology, and oncology. CAR‑T therapies

have transformed care for certain blood cancers (e.g., ALL, NHL). Active

research is broadening cell therapy utility to solid tumors by improving

trafficking, infiltration, and persistence within immunosuppressive

microenvironments. In immunology, cell therapies aim to reprogram or replace

dysfunctional immune cells to treat autoimmune diseases (e.g., rheumatoid

arthritis, multiple sclerosis).

Drivers

1) Rising

Incidence of Oncological Disorders

- Cancer remains a leading global

cause of morbidity and mortality, with millions of new cases annually,

underscoring the need for more effective, targeted treatments.

- Traditional options

(chemotherapy, radiation) have limited efficacy and significant toxicity

in late-stage disease, prompting demand for novel approaches.

- Immune cell therapies (e.g.,

CAR‑T) harness the immune system to specifically recognize and eliminate

malignant cells and are catalyzing investment and pipeline growth.

- Advances in genetic engineering

(e.g., gene editing, signaling domain optimization) are broadening

applicability and improving durability of responses.

2)

Increasing Financing & Investments in Cell Therapy

- Significant capital inflows

from both public and private sectors are accelerating R&D, clinical

programs, and commercialization.

- ExampleIn October 2024,

Bayer AG announced a US$ 250 Mn cell therapy manufacturing

facility in Berkeley, California (U.S.) to support BlueRock

Therapeutics’ Parkinson’s program (bemdaneprocel/BRT‑DA01), illustrating

strategic, long-horizon investment in scalable production.

- Funding enables capacity

expansion, faster trials, and infrastructure build‑out for broader

adoption.

Cell Therapy Market Snapshot

Report Coverage | Detail |

Size in 2024 | US$ 5.1 Bn |

Forecast Value in 2034 | More than US$ 51.6 Bn |

CAGR (2025–2034) | 22.9% |

Forecast Period | 2025–2034 |

Historical Data Available for | 2020–2024 |

Quantitative Units | US$ Bn (Value) |

Market Analysis | Segment analysis and regional analysis; qualitative review of drivers, restraints, opportunities, key trends, value chain, and key trend analysis. |

Competition Landscape | Competition matrix; company profiles with overview, product portfolio, sales footprint, key subsidiaries/distributors, strategy & recent developments, key financials. |

Format | Electronic (PDF) + Excel |

Segmentation | Cell Therapy Type; Origin; Therapeutic Area; Regions |

Companies Profiled | Novartis AG; Bristol‑Myers Squibb; IOVANCE Biotherapeutics; Janssen Biotech; CellTrans; Gamida Cell; Dendreon Pharmaceuticals; Kite Pharma; Adaptimmune; Takeda Pharmaceutical Company Limited |

Customization Scope | Available upon request |

Pricing | Available upon request |

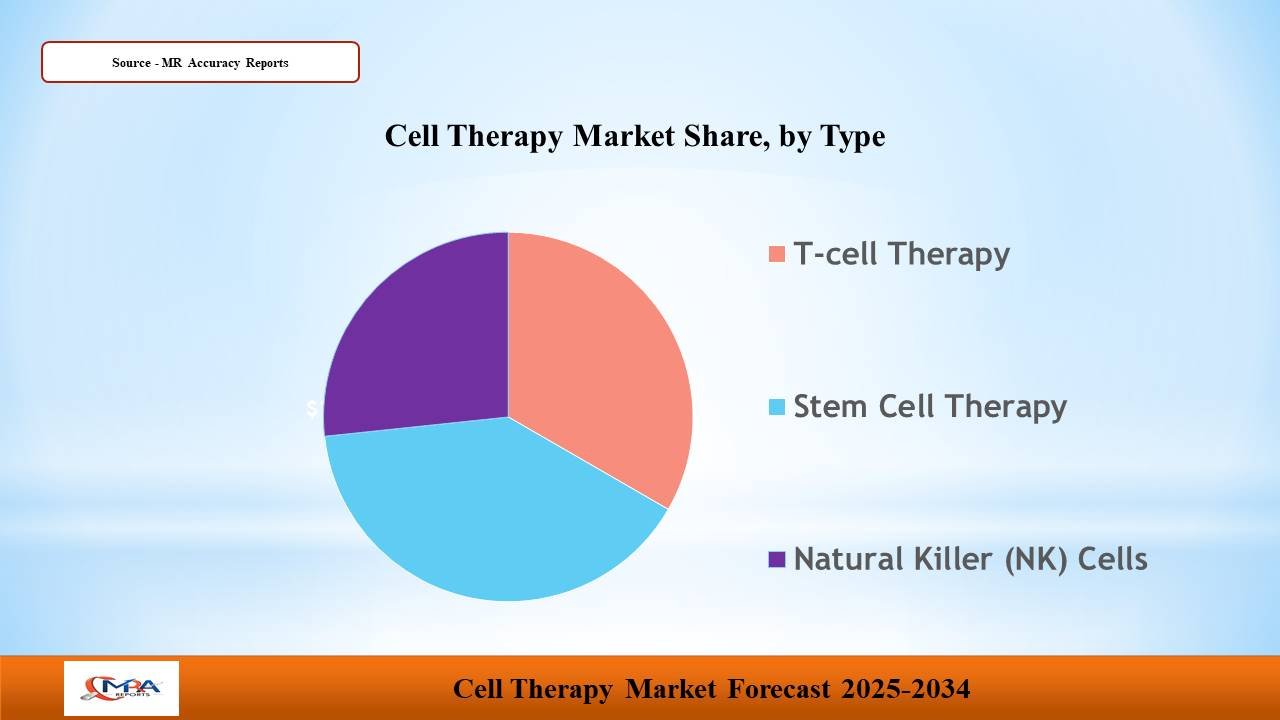

High Demand for T‑Cell Therapies

- Market segmentation by therapy

type includes T‑cell therapy, stem cell therapy, natural killer (NK)

cells, dendritic cells, and other cell therapies.

- With approvals of CAR‑T

products (e.g., Tecartus, Yescarta, Kymriah), many companies have

pivoted from small molecules/biologics to adoptive cell therapies,

boosting strategic investment.

- Rising approvals and

manufacturing capacity are intensifying competition in T‑cell therapy;

process enhancements are improving yields, turnaround times, and cost

structures.

- Next‑generation strategies (second/next‑gen CARs, logic‑gated

CARs, safety switches, gene‑edited allogeneic donors) aim to overcome

resistance, reduce adverse events, and expand indications.

Therapeutic AreasOncological Disorders Driving

Market Statistics

- By therapeutic area, the market

includes Oncological Disorders, Autoimmune Disorders, Neurological

Disorders, and Others.

- Oncology dominates, propelled by

patient-assistance programs (PAPs), government awareness initiatives,

rising cancer incidence, robust R&D by key players, and demand for

personalized medicine.

- Example initiativeIn November

2024, the American Cancer Society launched ACS CARES, a

mobile‑app program for one‑on‑one support and information access,

improving care navigation and potentially supporting therapy adoption.

Regional Outlook of the Cell Therapy Industry

- Leading regionNorth America (dominated in 2023 and

held the largest share in 2024), supported by advanced healthcare

infrastructure, strong R&D ecosystems, and higher healthcare spending.

- The U.S. leads North

America due to technology leadership, broad clinical trial networks, and

concentration of cell therapy developers and manufacturers.

- EuropeIncreased funding and

coordinated initiatives (e.g., EU research programs, the UK’s Cell

& Gene Therapy Catapult, Germany’s national initiatives) provide

infrastructure, translational support, and regulatory guidance.

- APACRapid build‑out of

biomanufacturing capacity and clinical sites supports future growth;

partnerships and localization strategies will be key for access and cost

control.

Analysis of Key Players

Prominent

companies include Novartis AG; Bristol‑Myers Squibb Company; IOVANCE

Biotherapeutics, Inc.; Janssen Biotech, Inc.; CellTrans, Inc.; Gamida Cell

Inc.; Dendreon Pharmaceuticals LLC; Kite Pharma, Inc.; Adaptimmune; and Takeda

Pharmaceutical Company Limited.

These players are profiled on company overview, financials, strategy, product

portfolio, segments, and recent developments.

Segmentation

By Cell

Therapy Type

- T‑cell Therapy

- Chimeric Antigen Receptor

(CAR) T‑cells

- T‑cell Receptors (TCR‑T)

- Tumor‑Infiltrating Lymphocytes

(TILs)

- Stem Cell Therapy

- Natural Killer (NK) Cells

- Dendritic Cells

- Other Cell Therapies

By Origin

- Autologous Therapies

- Allogeneic Therapies

By

Therapeutic Area

- Oncological Disorders

- Autoimmune Disorders

- Neurological Disorders

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

The global cell therapy market was estimated at US$ 5.1 billion in 2024.

The market is forecast to expand and surpass US$ 51.6 billion by 2034.

The industry is expected to grow at a CAGR of 22.9% between 2025 and 2034.

Novartis AG, Bristol-Myers Squibb

Company, IOVANCE Biotherapeutics, Inc., Janssen Biotech, Inc., CellTrans, Inc.,

Gamida Cell Inc., Dendreon Pharmaceuticals LLC, Kite Pharma, Inc., Adaptimmune,

and Takeda Pharmaceutical Company Limited

Related Reports

Table of Content

1. Summary

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Cell Therapy Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Cell Therapy Market Analysis and Forecasts, 2020 & 2034

4.4.1. Market Revenue Projections (US$ Bn)

5. Key Insights

5.1. Regulatory Landscape across Key Regions / Countries

5.2. Market Trends

5.3. PORTER’s Five Forces Analysis

5.4. PESTEL Analysis

5.5. Key Purchase Metrics for End-users

5.6. Brand and Pricing Analysis

5.7. Go to Marketing Strategies

5.8. End-users Preference

6. Global Cell Therapy Market Analysis and Forecasts, By Device Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast By Device Type, 2020 & 2034

7. Competition

Landscape

15.1. Market Player – Competition Matrix (By Tier and Size of companies)

15.2. Market Share Analysis By Company (2024)

15.3. Company Profiles

15.3.1. Company-1

15.3.1.1. Company Overview

15.3.1.2. Financial Overview

15.3.1.3. Product Portfolio

15.3.1.4. Business Strategies

15.3.1.5. Recent Developments

List of Figures

Figure 1: Global Cell Therapy Market Revenue Breakdown

(USD billion, %) by Region, 2025 & 2034

Figure 2: Global Cell Therapy Market Value Share (%),

by Type, 2025 & 2034

Figure 3: Global Cell Therapy Market Value Share (%),

by Application, 2025 & 2034

Figure 4: Global Cell Therapy Market Value Share

(%), by End-user, 2025 & 2034

Figure 5: North America Cell Therapy Market Value (USD

billion), by Type, 2025 & 2034

Figure 6: North America Cell Therapy Market Value

Share (%), by Type, 2024

Figure 7: North America Cell Therapy Market Value (USD

billion), by Application, 2025 & 2034

Figure 8: North America Cell Therapy Market Value

Share (%), by Application, 2024

Figure 9: North America Cell Therapy Market Value (USD

billion), By Country, 2025 & 2034

Figure 10: North America Cell Therapy Market Value

(USD billion), by End-user, 2025 & 2034

Figure 11: North America Cell Therapy Market

Value Share (%), by End-user, 2024

Figure 12: Europe Cell Therapy Market Value Share (%),

by Type, 2024

Figure 13: Europe Cell Therapy Market Value (USD

billion), by Application, 2025 & 2034

Figure 14: Europe Cell Therapy Market Value Share (%),

by Application, 2024

Figure 15: Europe Cell Therapy Market Value (USD

billion), By Country/ Sub-region, 2025 & 2034

Figure 16: Europe Cell Therapy Market Value Share (%),

By Country/ Sub-region, 2024

Figure 17: Asia Pacific Cell Therapy Market Value (USD

billion), by Type, 2025 & 2034

Figure 18: Europe Cell Therapy Market Value (USD

billion), by End-user, 2025 & 2034

Figure 19: Europe Cell Therapy Market Value

Share (%), by End-user, 2024

Figure 20: Asia Pacific Cell Therapy Market Value

Share (%), by Application, 2024

Figure 21: Asia Pacific Cell Therapy Market Value (USD

billion), By Country/ Sub-region, 2025 & 2034

Figure 22: Asia Pacific Cell Therapy Market Value

Share (%), By Country/ Sub-region, 2024

Figure 23: Rest of the World Cell Therapy Market Value

(USD billion), by Type, 2025 & 2034

Figure 24: Rest of the World Cell Therapy Market Value

Share (%), by Type, 2024

Figure 25: Rest of the World Cell Therapy Market Value

(USD billion), by Application, 2025 & 2034

Figure 26: Asia Pacific Cell Therapy Market

Value (USD billion),by End-user, 2025 & 2034

Figure 27: Asia Pacific Cell Therapy Market

Value Share (%), by End-user, 2024

Figure 28: Asia Pacific Cell Therapy Market

Value (USD billion), By Country/ Sub-region, 2025 & 2034

Figure 29: Asia Pacific Cell Therapy Market

Value Share (%), By Country/ Sub-region, 2024

Figure 30: Rest of World Cell Therapy Market

Value (USD billion), by Type, 2025 & 2034

Figure 31: Rest of World Cell Therapy Market

Value Share (%), by Type, 2024

Figure 32: Rest of World Cell Therapy Market

Value (USD billion), by Application, 2025 & 2034

Figure 33: Rest of World Cell Therapy Market

Value Share (%), by Application, 2024

Figure 34: Rest of World Cell Therapy Market

Value (USD billion), by End-user, 2025 & 2034

Figure 35: Rest of World Cell Therapy Market

Value Share (%), by End-user, 2024

Figure 36: Global Cell Therapy Market Share (%),

By Company, 2024

Table 1:

Global Cell Therapy Market Revenue (USD billion) Forecast, by Type, 2020–2034

Table 2:

Global Cell Therapy Market Revenue (USD billion) Forecast, by Product, 2020–2034

Table 3:

Global Cell Therapy Market Revenue (USD billion) Forecast, by Software, 2020–2034

Table 4:

Global Cell Therapy Market Revenue (USD billion) Forecast, by Services, 2020–2034

Table 5:

Global Cell Therapy Market Revenue (USD billion) Forecast, by Application, 2020–2034

Table 6:

Global Cell Therapy Market Revenue (USD billion) Forecast, by Menstruation Care

& Fertility Tracking, 2020–2034

Table 7:

Global Cell Therapy Market Revenue (USD billion) Forecast, by End-user 2020–2034

Table 8:

Global Cell Therapy Market Revenue (USD billion) Forecast, by Region, 2020–2034

Table 9:

North America Cell Therapy Market Revenue (USD billion) Forecast, by Type, 2020–2034

Table 10:

North America Cell Therapy Market Revenue (USD billion) Forecast, by Product, 2020–2034

Table 11:

North America Cell Therapy Market Revenue (USD billion) Forecast, by Software, 2020–2034

Table 12:

North America Cell Therapy Market Revenue (USD billion) Forecast, by Services, 2020–2034

Table 13:

North America Cell Therapy Market Revenue (USD billion) Forecast, by

Application, 2020–2034

Table 14:

North America Cell Therapy Market Revenue (USD billion) Forecast, by

Menstruation Care & Fertility Tracking, 2020–2034

Table 15:

North America Cell Therapy Market Revenue (USD billion) Forecast, by End-user 2020–2034

Table 16:

North America Cell Therapy Market Revenue (USD billion) Forecast, By Country, 2020–2034

Table 17:

Europe Cell Therapy Market Revenue (USD billion) Forecast, by Type, 2020–2034

Table 18:

Europe Cell Therapy Market Revenue (USD billion) Forecast, by Product, 2020–2034

Table 19:

Europe Cell Therapy Market Revenue (USD billion) Forecast, by Software, 2020–2034

Table 20:

Europe Cell Therapy Market Revenue (USD billion) Forecast, by Services, 2020–2034

Table 21:

Europe Cell Therapy Market Revenue (USD billion) Forecast, by Application, 2020–2034

Table 22:

Europe Cell Therapy Market Revenue (USD billion) Forecast, by Menstruation Care

& Fertility Tracking, 2020–2034

Table 23:

Europe Cell Therapy Market Revenue (USD billion) Forecast, by End-user 2020–2034

Table 24:

Europe Cell Therapy Market Revenue (USD billion) Forecast, By Country/

Sub-region, 2020–2034

Table 25:

Asia Pacific Cell Therapy Market Revenue (USD billion) Forecast, by Type, 2020–2034

Table 26:

Asia Pacific Cell Therapy Market Revenue (USD billion) Forecast, by Product, 2020–2034

Table 27:

Asia Pacific Cell Therapy Market Revenue (USD billion) Forecast, by Software, 2020–2034

Table 28:

Asia Pacific Cell Therapy Market Revenue (USD billion) Forecast, by Services, 2020–2034

Table 29:

Asia Pacific Cell Therapy Market Revenue (USD billion) Forecast, by Application,

2020–2034

Table 30:

Asia Pacific Cell Therapy Market Revenue (USD billion) Forecast, by

Menstruation Care & Fertility Tracking, 2020–2034

Table 31:

Asia Pacific Cell Therapy Market Revenue (USD billion) Forecast, by End-user 2020–2034

Table 32:

Asia Pacific Cell Therapy Market Revenue (USD billion) Forecast, By Country/

Sub-region, 2020–2034

Table 33:

Rest of World Cell Therapy Market Revenue (USD billion) Forecast, by Type, 2020–2034

Table 34:

Rest of World Cell Therapy Market Revenue (USD billion) Forecast, by Product, 2020–2034

Table 35:

Rest of World Cell Therapy Market Revenue (USD billion) Forecast, by Software, 2020–2034

Table 36:

Rest of World Cell Therapy Market Revenue (USD billion) Forecast, by Services, 2020–2034

Table 37:

Rest of World Cell Therapy Market Revenue (USD billion) Forecast, by

Application, 2020–2034

Table 38:

Rest of World Cell Therapy Market Revenue (USD billion) Forecast, by

Menstruation Care & Fertility Tracking, 2020–2034

Table 39:

Rest of World Cell Therapy Market Revenue (USD billion) Forecast, by End-user 2020–2034

- Bluebird Bio

- Adaptimmune

- Gilead Sciences

- Celyad

- Kite Pharma

- Sangamo Therapeutics

- Allogene Therapeutics

- TCR2 Therapeutics

- Celgene

- Novartis

- Fate Therapeutics

- BristolMyers Squibb

- AstraZeneca

- Amgen

- Juno Therapeutics

Claim a Free Sample

Get a preview with key statistics, projections, and trends for this report. Ideal for quick insights.

Send Me a SampleNeed full access?

Purchase Report